Product Know-how

Warrants

A culinary adventure

Perhaps it’s easiest to explain the way warrants function by applying an example from everyday life.

Imagine there’s an outstanding Italian restaurant in your neighborhood, and you’re one of their most loyal customers. As a gesture of gratitude, the proprietor sells you a couple of gift certificates for dinner valued at CHF 15 for the special price of CHF 10. They’re valid for two years’ time, and the normal price these days for a meal is CHF 12.00. Because you’d save CHF 2 by using the gift certificate today, it essentially has a value of CHF 2. So let’s call that value the “intrinsic value” of the certificate.

Six months later, the restaurant finds it necessary to hike the price of a meal because increasing wage costs and energy prices leave it no other choice, so now a dinner costs CHF 14, 16% more than a while back. But with your gift certificate, you can still enjoy a meal for CHF 10.00. It doesn’t take a rocket scientist to figure out that the certificate now has an intrinsic value of at least CHF 4. In other words, its value has risen by 50% - much more than the percentage increase in the price of a meal. Thus the gift certificate has experienced “leverage” because of the price change.

Ah…but imagine that the price of a meal suddenly dropped to CHF 10.00. At least for the time being, your gift certificates would be worth nothing because they offer you no advantage over a direct purchase of the meal. But would you simply throw them away? Probably not, because as long as they remain valid, the possibility still exists that the restaurant owner will opt to raise his prices, at which point the certificates would have value again.

So as you can see, it’s not just intrinsic value that plays a role in such a gift certificate - there’s also a kind of “time value” involved. That time value is a reflection of the likelihood (or lack thereof) that the certificate will gain in value at some point before it’s term of validity runs out.

Call Warrant

If you can comprehend the foregoing example, you’ll have no problem understanding how warrants work. What you just learned is already the basic principle of a call warrant.

A call warrant confers the right to buy a specific quantity of a specific underlying instrument at a specific price over a specific period of time. Obviously, the underlying instrument isn’t a meal in your favorite Italian restaurant, but rather a certain stock, index, currency or commodity.

With some warrants, the option right can only be exercised on the expiration date. These are referred to as “European-style” warrants. With “American-style” warrants, the option right can be exercised at any time prior to expiration. But these designations have nothing to do with the given market in which the warrants are traded or the origin of the underlying instrument! When they are issued, warrants usually have a term to expiration between several months and several years.

At this point, it should be stressed that most investors rarely buy a warrant with the intent of actually exercising the option and purchasing the underlying instrument. Rather, their objective is to bet on a price increase in the warrant and then sell the leverage product for more money than it originally cost. Exercising a warrant normally makes no economic sense: upon exercise, you only realize the intrinsic value of the warrant while forgoing its time value.

Put Warrants

A put warrant confers the right to sell a specific quantity of a specific underlying instrument at a specific price over a specific period of time. It follows that this right increases in value if the price of the underlying instrument drops, so you as the holder would profit from such a move.

No turnover? No problem!

As a general rule, warrants are issued by major banks and brokerage houses. For all products listed on Scoach Switzerland Ltd, the issuers are obligated to post continual bid and ask prices for their products so that they are effectively tradable even though no transactions have taken place for a longer period of time.

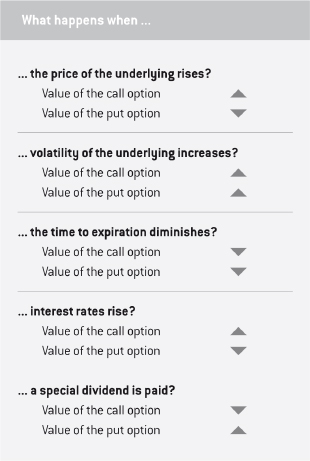

Factors that influence pricing

Not only do changes in the price of the underlying instrument influence the value of a warrant, a number of other factors are also involved. Of particular importance to investors in this regard are changes in volatility, i.e. the degree to which the price of the underlying instrument fluctuates. In addition, changes in interest rates and the anticipated dividend payments on the underlying instrument also play a role.

Historical and implied volatility

In addressing this topic, a differentiation has to be made between historical and implied volatility. Historical volatility indicates how sharply the price of a financial instrument has fluctuated in the past, whereas implied volatility shows the degree of fluctuation market participants expect to see in the financial instrument in the days and months ahead. If implied volatility for the underlying instrument increases, so does the price of the warrant.

Why’s that?

Warrants have an asymmetrical risk/reward profile. Put simply: For you as a buyer, the maximum loss you can incur - regardless of where the underlying instrument might trade - is always limited to the amount of money you put on the line. But the chances of profiting from a warrant increase if the price of the underlying instrument gyrates widely and the peaks and troughs are farther apart. For that reason, increasing implied volatility causes warrants to gain in value.

Ah…but here again we’ve got a door that swings both ways. If implied volatility decreases, that leads to a decline in the value of warrants and hence occasionally to nasty surprises for warrant investors who aren’t familiar with the concept and influence of volatility.

In most cases, investors in call warrants are the ones who are impacted by this syndrome. Frequently, it can be observed in the equity markets that implied volatility wanes when prices increase, and vice versa. Yes, the rise in share prices has a favorable influence on call warrants, but at the same time the drop in implied volatility exerts a negative influence so that price gains in the call warrants are less dramatic than hoped for. In extreme cases, the influence of a sharp drop in implied volatility can more than neutralize the price gains of the underlying instrument.

However, changes in implied volatility - as well as interest rates and dividends - only affect the time value of a warrant. The primary driver - intrinsic value - is solely determined by the difference between the price of the underlying instrument and the specified exercise price.

You can therefore significantly reduce the influence of volatility fluctuations by buying warrants that are “in the money”, i.e. those that already have a high intrinsic value. Bear in mind however that implied volatility also serves as a yardstick for how expensive a warrant is. If you have the choice between several warrants with essentially similar features, you’re best advised to opt for the one with the lowest implied volatility.

Interest rates and dividends

Issuers of structured products are never betting against you. For them to make a profit, they don’t have to hope that the value of the warrant declines and you suffer a loss. Rather, they hedge themselves against price changes in the warrant through purchases and sales of the underlying instrument so that the total hedged position responds as precisely as possible to the value of the warrant. The hedge is closed out as soon as you sell your position back to the issuer.

However, due to the leverage afforded by warrants, the issuer needs considerably more capital to hedge its position than you require to buy the warrants. And for that larger amount of capital, the issuer charges you a kind of interest that is included in the price of the warrant. Hence rising interest rates lead to increasing prices for call warrants. In the case of puts, the situation is exactly the opposite. Here, the issuer sells the underlying instrument short to establish the necessary hedge, and in so doing receives capital that can earn interest. Thus an increase in interest rates causes lower prices for put warrants. That being said, however, the influence of interest rate changes is normally so slight that you as an investor will hardly ever notice it.

If the issuer owns shares as a part of its hedging operations, it naturally is also entitled to receive the related dividend payments. That additional income reduces the price of call warrants and increases the price for puts. But if the dividend expectations change, that will have an influence on the price of the warrants (see table). Unanticipated special dividends on the underlying instrument can lead to a price decline in the related warrants.

Key valuation factors

As previously discussed, various factors influence the price of a warrant. So now we’ll take a closer look at the most important ones by applying the same example we showed you earlier, i.e. a call warrant on Credit Suisse:

| Term to expiration: | 2 years |

| Underlying : | CS Group N |

| Share price: | CHF 30.00 |

| Strike: | CHF 30.00 |

| Exercise ratio: | 0.1 |

| Warrants price: | CHF 1.30 |

Intrinsic value

Intrinsic value represents the amount you could receive if you exercised the warrant immediately and then bought (in the case of a call) or sold (put) the underlying instrument in the open market.

It’s very easy to calculate the intrinsic value of a warrant. In our example of a call warrant on Credit Suisse, the intrinsic value is CHF 00.00 and is calculated as follows:

(price of underlying instrument – strike price) x exercise ratio

= (CHF 30.00 – CHF 30.00) x 0.1

= CHF 00.00

The intrinsic value of a put warrant is calculated with this formula:

(strike price – price of underlying instrument) x exercise ratio

It’s important to note that the intrinsic value of a warrant can never be negative. By way of explanation: if the price of the underlying instrument is at or below the exercise price, the intrinsic value of a call equals zero. In this instance, the price of the warrant consists only of “time value”. On the flipside, the intrinsic value of a put is equal to zero if the price of the underlying instrument is at or above the exercise price.

Time value

Once you’ve calculated the intrinsic value of a warrant, it’s also easy to figure out what the time value of that warrant is. You simply deduct the intrinsic value from the current market price of the warrant. In our example, the time value is equal to CHF 1.30 as you can see from the following calculation:

(warrant price – intrinsic value)

= (CHF 1.30 CHF – CHF 0.00)

= CHF 1.30

Time value gradually erodes during the term of a warrant and ultimately ends up at zero upon expiration. At that point, warrants with no intrinsic value expire worthless. Otherwise you can expect to receive payment of the intrinsic value. Take note, though: a warrant’s loss of time value accelerates during the final months of its term, so when buying a warrant you should take care that there is a sufficient amount of time remaining until it expires.

Premium

The premium indicates how much more expensive a purchase/sale of the underlying instrument would be via the purchase of a warrant and the immediate exercise of the option right as opposed to simply buying/selling the underlying instrument in the open market.

Hence the premium is a measure of how expensive a warrant actually is. It follows that, when given a choice between warrants with similar features, you should always buy the one with the lowest premium. By calculating the premium as an annualized percentage, warrants with different terms to expiry can be compared with each other.

The percentage premium for the call warrant in our example can be calculated as follows:

(strike price + warrant price / exercise ratio – share price) / share price * 100

= CHF 30.00 + CHF 1.30 / 0.1 – CHF 30.00) / CHF 30.00 x 100

= 43.3 percent

Breakeven

The breakeven point indicates the price level that the underlying instrument has to exceed (call) or fall below (put) for you to avoid suffering a loss by holding the warrant through to expiration. However, it is only of relevance to investors who actually wish to keep their warrant position open until the expiration date.

The breakeven point for a call is calculated as follows:

strike price + warrant price / exercise ratio

= CHF 30.00 + CHF 1.30 / 0.1

= CHF 43.00

The formula for the breakeven point of a put is a bit different:

strike price – warrant price / exercise ratio

= CHF 30.00 – CHF 1.30 / 0.1

= CHF 17.00

Delta

Delta is frequently referred to as “price sensitivity”. It indicates how sharply the price of a warrant changes when the underlying instrument moves by a given amount. The exercise ratio has to be taken into account in this regard. For example, a call warrant with a delta of 0.60 and an exercise ratio of 0.1 will rise or fall in price by roughly CHF 0.06 when the underlying instrument moves up or down by CHF 1.00.

As is the case with all of these indicators, delta is only a snapshot at a specific moment in time. The reading theoretically changes as soon as one of the price-influencing factors changes by even the slightest amount, e.g. the price of the underlying instrument. So bear in mind that the proper interpretation of such an indicator requires that none of the other influencing factors have changed in the meantime. In other words, all of these indicators serve only as a point of reference on how the price of a warrant is behaving at present. Nevertheless, delta is one of the key tools for the assessment of a warrant.

Calculating delta is mathematically very complex. One possible formula for doing so can be derived from the “Black-Scholes options pricing model”, whose developers (Fisher Black and Myron Scholes) won the 1997 Nobel Prize in Economics.

Call warrants always have a delta between 0 and +1. Because put warrants respond oppositely to price changes in the underlying instrument, their delta is always between -1 and 0.

Warrants with a delta close to zero hardly respond at all to movements in the underlying instrument, thus their fluctuations are extremely unpredictable because they react almost solely to changes in implied volatility. Warrant experts advise novices to choose issues that have a delta between 0.50 and 0.70.

Omega

Omega indicates the degree of leverage associated with a given warrant. The warrant in our example has an omega of close to 4. Thus its price would rise or fall by roughly 4% in response to a 1% move in the underlying instrument.

But here again, omega is just a snapshot in time. The value of this reading changes with each tick in the underlying instrument. Interpreting it correctly requires that no other price-influencing factor changes (i.e. volatility, interest rates, dividends and term to expiration).

In the case of warrants with a very low delta, the meaningfulness of omega is generally quite limited. For all other warrants, however, omega is by all means an appropriate indicator for assessing the risk/reward profile of a warrant, and thus it’s a very important aid for you as an investor. Generally speaking, the higher the omega, the greater the profit opportunities and risks are of a given warrant.

In addition to omega, there is another yardstick for assessing the leverage of a warrant: “current leverage”. Because delta is not required for the calculation of this reading, current leverage is much easier to determine. But in many cases it’s misleading and lacks significance.

Theta

Theta always relates to a specific time frame and measures a warrant’s loss of time value. The warrant in our example has a theta of 0.40% per week, thus in theory it will lose 0.4% of its value each week, assuming all other price-influencing factors remain unchanged. The erosion of warrant’s time value accelerates in the final months of its term to expiration, especially if the warrant is trading “at the money” (i.e. the price of the underlying instrument is close to the exercise price).

There are additional indicators that are used in the valuation/evaluation of warrants. They can be accessed at our www.six-structured-products.com website for all warrants traded on SIX Swiss Exchange. There you can also find further explanations and practical tips with regard to specific product types and key valuation indicators.

Call warrant

| Term to expiration: | 2 years |

| Underlying : | CS Group N |

| Share price: | CHF 30.00 |

| Volatility: | 80 percent |

| Strike price: | CHF 30.00 |

| Exercise ratio: | 0.1 |

| Warrants price: | CHF 1.30 |

The exercise ratio of 0.1 indicates that the warrant represents one-tenth of a CS Group registered share. Warrants frequently feature a fractional exercise ratio so that they are less expensive to purchase and can be easily denominated also for smaller investment amounts.

In this example, you could buy one share of Credit Suisse for CHF 30 (the “strike price”) at any time over the next two years by exercising ten of these warrants, regardless of where the stock might currently stand. Thus it’s logical that this right will have all the more value the higher the stock goes. For example, if Credit Suisse were to hit CHF 36, the warrant would be worth something like CHF 1.70 (depending on the time left until expiration). Later, you can conduct this type of scenario computation on your own with the help of the warrant calculator available at www.six-structured-products.com. But back to the story: In the situation described, the warrant would record almost a 35% gain while the shares tacked-on «only» 20%.

Put Warrant

| Term to expiration: | 0.5 years |

| Underlying : | UBS N |

| Share price: | CHF 15.00 |

| Volatility: | 80 percent |

| Strike price: | CHF 15.00 |

| Exercise ratio: | 0.1 |

| Warrants price: | CHF 0.32 |

Any investment in securities carries certain risks. In terms of warrants, the following special risks apply in particular:

- Leverage: Due to the leverage afforded by warrants, sizeable losses can be incurred within a short period of time, even to the point of a total loss.

- Limited term: Generally, the lifespan of a warrant is limited. The rights you acquire through the purchase of a warrant can lose their value during its term or lapse entirely on expiration date. The shorter a warrant’s remaining term, the greater the risk of a loss in value because the time-value deterioration is especially high as the expiration date approaches and there is little time remaining for the speculation to pay off.

- Other price-influencing factors: Changes in implied volatility can have a considerable impact on the value of warrants. In addition, their value is influenced by changing interest rates, altered expectations for dividends on the underlying instrument, as well as attrition of the remaining term to expiration.

- Underlying instruments denominated in foreign currency: If the underlying instrument is traded in a currency other than the Swiss franc, investors bear an additional foreign exchange risk because the intrinsic value of the warrant is calculated in that foreign currency.

- From a legal standpoint, almost all leverage products are considered to be debt instruments of the given issuer. If the issuer were to have difficulty meeting its payments or become insolvent, the invested capital is not protected. Hence the investor also bears a creditworthiness risk.

Login

Login