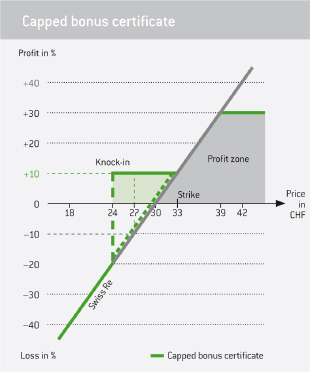

Capped bonus certificates

Except for its upside limit, a capped bonus certificate is just the same as a normal bonus certificate. Due to the cap, the safety buffer for this product can be increased. Accordingly, capped bonus certificates are suited to investors who want greater bonus protection and/or a downside cushion against loss, but at the same time desire to participate in a price advance up to the level of the cap. As with normal bonus certificates, you’ll participate 1:1 in any upside move in the underlying instrument.

Example of a capped bonus certificate

| Remainung term to maturity : | 2 years |

| Underlying : | Swiss RE |

| Bonus level: | CHF 33.00 |

| Cap level: | CHF 39.00 |

| Safety threshold: | CHF 24.00 |

| Current price of certificate: | CHF 30.00 |

| Current price of stock: | CHF 30.00 |

If the safety threshold of this capped bonus certificate remains untouched during the entire term to maturity, you’re assured of earning a 10 percent return. But if it is violated, you’ll immediately start to participate 1:1 in any further losses recorded by Swiss RE. Here, too, a cap limits your upside potential. In other words, if Swiss RE were to have risen 40 percent by the time the certificate matures, you’d in effect only earn a 30 percent profit on your investment.

Login

Login