Capped outperformance certificates

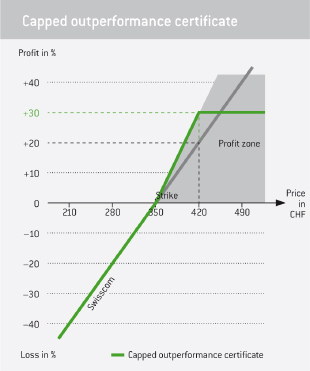

As the name implies, this product is an outperformance certificate that is limited (capped) on the upside. Because you forgo any further gains once that cap has been hit, you’re entitled to benefit from a higher participation rate than is the case with normal outperformance certificates. At any level above the strike price, you participate disproportionately in the gains of the underlying instrument, whereby that participation rate is dependent among other things on the cap level and the dividends that you would normally receive if you held the underlying security outright. The difference between this product and a capped bonus certificate is that, here, no partial protection is afforded.

Capped outperformance certificates are best suited to investors who expect the market to rise modestly but still remain within the band between the strike price and the cap. If at maturity the price ends up within this range, you’ll earn a larger profit than you would have by investing directly in the underlying instrument or from a “plain vanilla” outperformance certificate.

Example of a capped outperformance certificate

| Remainung term to maturity : | 2 years |

| Underlying : | Swisscom |

| Strike price: | CHF 350.00 |

| Cap level: | CHF 420.00 |

| Participation factor: | 150 percent |

| Current price of certificate: | CHF 350.00 |

| Current price of stock: | CHF 350.00 |

Up to the cap of CHF 420, you’ll participate in the gain at a rate of 150 percent. Thus if Swisscom rises by 20 percent to CHF 420, you’ll book a 30 percent profit. However, your participation in the gain will stop once the cap is exceeded. In other words, even if the Swisscom were to go up by 40 percent, your profit would be limited to 30 percent.

Login

Login