Exchange Trading

On Order Book

The substance of Exchange trading pertains exclusively to cash and forward transactions in securities traded on SIX Swiss Exchange.

These Exchange transactions are settled on a "trade-date plus three" (T+3) basis; in other words, customary practice requires the delivery versus payment of the securities involved in an Exchange transaction to take place on the third banking day following the date of execution.

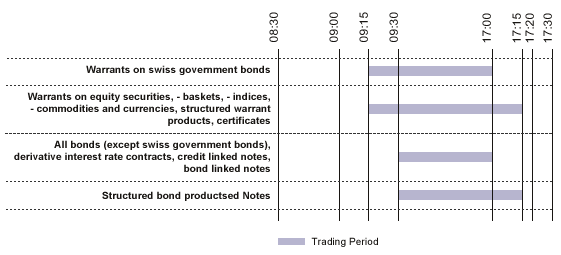

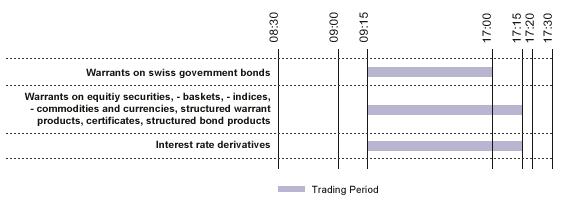

Exchange hours for the Quote Driven Market of SWXess platform

SIX Swiss Exchange is open for business daily from Monday through Friday, but remains closed on national holidays.

The Exchange reserves the right, upon prior notification, to remain closed also on other days.

The precise business and trading hours are specified in Directives as well as the SIX trading calendar (see Directive 3: Trading, Product Guide - Structured Products Market).

In exceptional circumstances the Exchange may modify trading days or trading periods for entire market segments, or the market as a whole. In the case of a temporary suspension of trading in individual issues or entire market segments, no opening or continuous trading takes place in the related securities (see Rule Book).

Trading Calendar

The trading calendar provides informations on the valuta days of the single currencies and the market holidays of SIX Swiss Exchange. Click here to view the trading calendar display.

Login

Login