Exchange Trading

Off Order Book

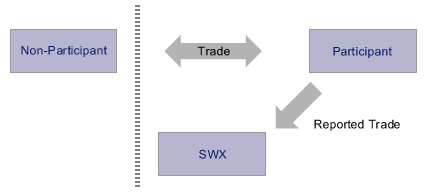

The Exchange System supports the various forms of off-order book trading. Throughout the entire period of exchange operation, i.e. during continual trading, participants have at their disposal the following off-order book functional features:

— Trade Confirmation (TC)

— Reported Trade (RT)

Extraordinary situations

In effort to ensure fair and orderly trading to the greatest extent possible, the SIX Swiss Exchange may intervene by taking appropriate measures (Rule Book and Trading Guides).

Delayed Opening

If the theoretical opening price equals or exceeds an Exchange-specified tolerance range, the opening in the given security is delayed by either 5 or 15 minutes, depending on the situation. These ranges and time frames are laid down in the SIX Swiss Exchange Trading Guide.

Suspension of trading

Trading may be temporarily suspended in individual issues or entire market segments. For the securities involved, no opening or continual trading will take place.

Handling of mistrades

Under certain circumstances, market control may investigate a transaction executed by the Exchange system and, if necessary, declare the trade null and void.

In the case of an execution that deviates considerably from the going market price and is thus at conflict with the principle of fair and orderly trading, SIX Swiss Exchange Ltd has the right to intervene and nullify the trade (Rule Book).

Fees

To those market makers/liquidity providers who are linked with the quote system, SIX Swiss Exchange Ltd charges a QPS capacity fee. Dedicated as well as non-dedicated (“shared”) QPS are at their disposal where Shared QPS can only be purchased as part of a package. (see List of Charges under the Trading Rules).

Management of SIX Swiss Exchange AG reserves the right to alter the fee schedule if necessary.

Sanctions

If the rules laid down in the Trading Rules or the Directives of SIX Swiss Exchange are breached, Surveillance & Enforcement (SVE) or the Sanction Commission may pronounce sanctions against the participant or trader(s) concerned.

Further details can be found here.

Login

Login