Product Know-how

Knock-out warrants

Knock-out warrants are also leverage investment products but have several characteristics that differ from those of call or put warrants:

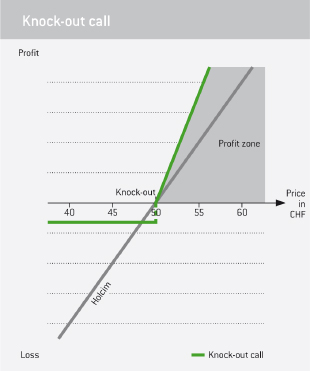

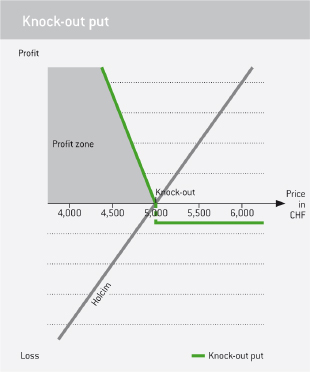

- Knock-out warrants can expire prematurely if the price of the underlying instrument falls below (in the case of knock-out calls) or exceeds (in the case of knock-out puts) a predetermined level. Depending on the features of the given product, it then expires worthless or a specified amount is paid back to the investor.

- Changes in implied volatility have little or no impact on knock-out products, therefore their pricing is easier for investors to comprehend than in the case of warrants.

- Knock-out products possess little or no time value and have a higher degree of leverage than similarly structured warrants.

- Due to the possibility of getting “knocked out”, as well as the higher degree of leverage involved, knock-out products are riskier than other types of warrant.

Premium

As is the case with normal warrants, issuers of knock-out warrants establish hedges by buying or selling the underlying instrument so they don’t have to speculate against investors. However, due to the leverage of knock-out calls, the issuer who sells them to the public has to invest a significantly greater amount of capital than the investors do. Thus the issuer essentially passes-through to investors the related interest costs by means of the premium.

When they sell knock-out puts to investors, issuers must short the underlying instrument in order to establish a hedge. As a result, they receive capital that can be invested to earn short-term interest. For that reason, it’s not rare that that knock-out puts actually trade with a negative premium (discount), in which case the product costs less than its intrinsic value.

Leverage

The leverage of knock-out warrants can be calculated as follows:

(price of underlying instrument x exercise ratio) / price of knock-out warrant

= (CHF 55.00 x 0.1) / CHF 0.57

= CHF 9.65

Consequently, the knock-out call in our example would gain almost 10% in value if the price of Holcim stock rises by 1%. But bear in mind that all valuation factors are a snapshot at a moment in time and, as we said before, leverage is a door that swings both ways. Price declines in the underlying instrument can rapidly lead to very large losses. And if Holcim stock trades at or below the CHF 50.00 mark, you’ll incur a total loss unless you’ve sold your holdings prior to the knock-out event.

The greater the leverage of a knock-out product, the greater the opportunity to profit from it. But the risk is also greater. When buying knock-outs, investors should absolutely make sure that there is a sufficient buffer between the price of the underlying instrument and the knock-out level.

Product types

Generally speaking, there are two different types of knock-out products:

- Knock-out warrants without a stop-loss level: For this type of product – as is the case in our previous example – the strike price and knock-out threshold are identical.

- Knock-out products with a stop-loss level: For this type of product, the knock-out threshold lies above (calls) or below (puts) the strike price. If the knock-out level is violated, the product also terminates immediately but as a rule you will receive payment of a residual value. Because the knock-out level for these products acts like a normal stop order, that threshold is usually referred to as the “stop-loss level”.

At the time they are issued, most knock-out products have a term to expiration of several weeks to several months. But some knock-outs feature an unlimited term and termination only once the price of the underlying security touches or penetrates the stop-loss level. These products have no premium, thus their price always corresponds to their intrinsic value.

Because the interest associated with the issuer’s hedging operations also applies to open-end products, the exercise price (financing level) and stop-loss level are adjusted at regular intervals, thus the intrinsic value of the products also changes. So it’s important to know that, in the case of a longer holding period, the intrinsic value of such a knock-out warrant can decline if the price of the underlying instrument simply trades sideways.

Take for instance the following knock-out call:

| Term to expiration: | 0.5 years |

| Underlying : | Holcim N |

| Share price: | CHF 55.00 |

| Volatility: | 50 percent |

| Strike price: | CHF 50.00 |

| Knock-out threshold: | CHF 50.00 |

| Exercise ratio: | 0.1 |

| Price of the product: | CHF 0.57 |

Because in this example the knock-out level is not very far away from the current market price of the underlying instrument, this represents a very speculative product with a high degree of leverage. The intrinsic value of this knock-out call can be calculated just the same way as that of a normal warrant: (price of underlying instrument – strike price) x exercise ratio = (CHF 55.00 – CHF 50.00) x 0.1 = CHF 0.50 The difference between the intrinsic value and the current price of the product (CHF 0.07) represents the premium. The premium gradually erodes until the end of the term, at which point it will amount to zero. As is the case with a “plain vanilla” warrant, on the expiration date you as an investor will receive payment of the difference between the current market price of the shares and the exercise price. So if, for example, the shares are trading at CHF 60 at expiration, the intrinsic value – and hence the repayment amount – would amount to CHF 1. However, the knock-out warrant would expire prematurely if the share price of Holcim touches or falls below CHF 50. For all intents and purposes, the product is then worthless.

Take for instance the following knock-out put:

Cookie notification

Our website uses cookies. This enables us to optimize your user experience. By continuing to use our website, you agree to this. To find out more, please see our Privacy Policy.

Required for login, security and essential site features. These cookies cannot be disabled.

Store settings such as watchlists, indicators, pop-up preferences or language.

Helps us measure campaigns and site usage (e.g. Google Tag Manager, etracker).

Login

Login