Product Know-how

Bonus certificates

During the bull market years of 2003 through 2006, many investors in discount certificates were annoyed that, because of the predetermined cap, their returns lagged those to be had in the general market. At the same time, though, they didn’t want to make do without a certain safety buffer against price declines.

The solution to that problem was the bonus certificate.

At the time they’re issued, bonus certificates normally have a term to maturity of two to four years. They guarantee that you’ll receive a specified payout (“bonus level”) as long as the underlying instrument doesn’t touch or fall below an established price level (“safety threshold”) during the term of the certificate.

In contrast to discount certificates, the maximum payback isn’t limited to a fixed amount: if the underlying instrument rises above the bonus level, you continue to participate in the price gains. Depending on the features of the product, you can often earn double-digit returns while assuming an acceptable degree of risk.

However, if the safety threshold is breached, then the protective mechanism of the bonus certificate vanishes in a heartbeat. In such an instance, you’ll be in the same economic situation when the certificate matures as you would have been had you invested directly in the underlying instrument. Once the breach occurs, the certificate behaves just like an index certificate.

If after a penetration of the safety threshold the price of the underlying instrument goes back up, you can still participate 1:1 in those gains; however, the right to a guaranteed payout of the bonus level no longer exists and it is not reinstated as a result of any such move.

The probability that the safety threshold will be penetrated already increases when the price of the underlying instrument starts to ease toward that level. Thus in this example, the price of the bonus certificate can retreat significantly even before the threshold is hit. By the same token, the price can rise all the more sharply when the underlying instrument gains distance again from the safety threshold without having penetrated it.

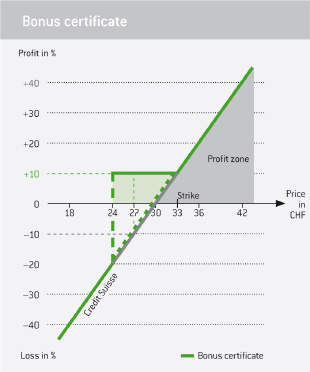

Example of a bonus certificate

| Remaining term to maturity:: | 2 years |

| Underlying : | CS Group N |

| Bonus level: | CHF 33.00 |

| Safety threshold: | CHF 24.00 |

| Current price of certificate: | CHF 30.00 |

| Current price of stock: | CHF 30.00 |

If during the term of the certificate the shares of Credit Suisse never trade at or below the safety threshold of CHF 24, upon maturity you’ll receive payment of at least the bonus amount of CHF 33, regardless of where the share price stands at that point. That equates to a total return of roughly 10% on the original amount invested. But the return can be even more generous if the stock actually trades higher than the bonus level. In such an instance, you’d participate fully in the additional price increase.

If, however, the safety threshold of CHF 24 is breached during the term to maturity, the bonus mechanism terminates, in which case you’ll receive the current market value of the stock when the certificate matures. If the share price is below the price you originally paid for the certificate (i.e. CHF 30), you’ll suffer a loss.

A classic bonus certificate affords you unlimited profit opportunities and simultaneously offers a safety buffer against moderate price declines. However with a bonus certificate - as is the case with most other types of structured product - you forgo the receipt of a dividend. With the dividends that are paid on the underlying instrument, the issuer finances the protective mechanism of the product. For that reason, bonus certificates on shares that pay a high dividend often have a particularly attractive risk/reward profile.

Depending on their specific features, bonus certificates are suited for rising, sideways and moderately falling markets. Of decisive importance to you as an investor is that the safety threshold is not hit at any time during the term of the certificate. Therefore, when buying a bonus certificate, it’s imperative that you make sure there’s enough leeway between the current market price of the underlying instrument and the safety threshold.

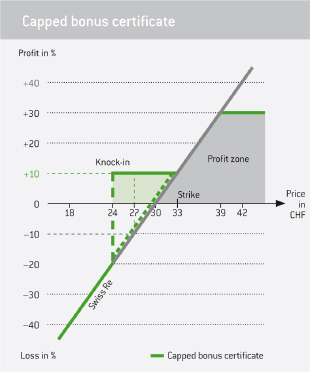

Example of a capped bonus certificate

| Remainung term to maturity : | 2 years |

| Underlying : | Swiss RE |

| Bonus level: | CHF 33.00 |

| Cap level: | CHF 39.00 |

| Safety threshold: | CHF 24.00 |

| Current price of certificate: | CHF 30.00 |

| Current price of stock: | CHF 30.00 |

If the safety threshold of this capped bonus certificate remains untouched during the entire term to maturity, you’re assured of earning a 10 percent return. But if it is violated, you’ll immediately start to participate 1:1 in any further losses recorded by Swiss RE. Here, too, a cap limits your upside potential. In other words, if Swiss RE were to have risen 40 percent by the time the certificate matures, you’d in effect only earn a 30 percent profit on your investment.

Cookie notification

Our website uses cookies. This enables us to optimize your user experience. By continuing to use our website, you agree to this. To find out more, please see our Privacy Policy.

Required for login, security and essential site features. These cookies cannot be disabled.

Store settings such as watchlists, indicators, pop-up preferences or language.

Helps us measure campaigns and site usage (e.g. Google Tag Manager, etracker).

Login

Login